At the midpoint of the year the fine wine market finds itself in reasonable health. The 2013 Burgundy and 2014 Bordeaux en primeur campaigns have passed with varying degrees of success and contention; Robert Parker’s much anticipated ten year review of the 2005 Bordeaux vintage has recently been released, precipitating relief and exasperation in equal measure. Overarching all is the thought that the tribulations of the previous four years have at last been becalmed.

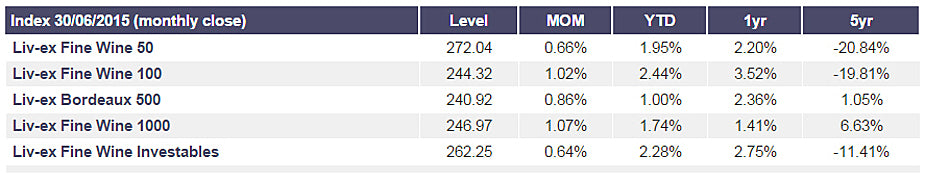

June saw the Liv-ex 100 index close at 244, up two points on the previous month’s close. Notably it was the first time the index has closed up year on year since November 2013. Whereas then the month’s close was a 2.6% decrease on October 2013 and the eighth month in a row the index had closed down (it would be another nine months before the index posted a positive return); now, barring one small reverse in February, it has been an upward trajectory. The fact that it is a shallow gradient is encouraging; offers have finally found a level of support.

Whilst the Liv-ex 100 is composed of the ten most recent physical vintages and weighted towards Bordeaux (73%), the picture is the same elsewhere: the Liv-ex 500, Liv-ex 1000 and Liv-ex Investable indices (each composed of an ever larger cross section of wines) all closed the month and year on year up, suggesting a breadth of buyers that bodes well for the second half of the year.

Problems with Primeurs

Recent Bordeaux primeur campaigns have, on occasion, borne more in common with the martial than the commercial. Châteaux at odds with merchants over allocations and release prices, each party equally trenchant of opinion emboldened by a chorus of commentators and arbiters of egality proffering opinion. Plus ça change one might think.

However, it is possible to discern some (new) order from the chaos. As mentioned previously in this report, recent Bordeaux vintages have seen some ambitious release prices. It is debatable whether the undoubted quality of some wines could ever fully justify their release prices and plainly, on occasion, the châteaux got it wrong and were chastised accordingly.

Happily the quantity and quality of the 2014 vintage offered a chance at redemption. Needless to say the naysayers were quick with pre-emptive warnings; the châteaux paid little heed (certainly in public) to these supplications and did as their wont.

Whilst the results were not an unmitigated success, some châteaux were determined to maintain a price point no matter how unviable, those that considered the market and, crucially, sentiment found favour with merchants and customers alike. The fact that release prices were not necessarily cheaper than every back vintage mattered not; merchants and clients perceived value and in the fullness of time the latter will reap the benefits.

It is unrealistic to expect Bordeaux châteaux to ‘give’ their wines away, just as it is detrimental to the market for châteaux to overreach. It is a fine balance but it would seem with 2014 that the scales are beginning to rebalance.

A matter of taste

Issue 219 of the Wine Advocate revealed Robert Parker’s ten year review of Bordeaux 2005, a vintage in which we at Goedhuis are firm believers. Trade for these wines suggests we are not alone in recognising its staggering quality. There has been an steady increase in prices for the top wines from the vintage for over a year, remarkably it was possible to purchase first growths within 10% of their release prices not so long ago. This fact played no small part in convincing buyers to reengage with the market. Robert Parker’s review would, no doubt, burnish its reputation further.

“The vintage does have fabulous peaks of quality in Pomerol, St.-Emilion, Graves and Margaux (probably one of the best sets of wines of any appellation), but while St.-Julien, Pauillac and St.-Estèphe have produced many outstanding wines, for some reason, those wines seem to lack the “wow” factor. Nevertheless, this vintage looks strong and impressive at age ten. I do believe it is eclipsed in quality and consistency by both the 2009s and 2010s, but only by a relatively minor margin.” Robert Parker Wine Advocate Issue 219, June 2015

The point (or points) of contention stem from Parker’s somewhat miserly scoring of the great Medoc wines relative to his munificent reviews of the right bank, which boasts ten of the twelve ‘perfect’ 100 point wines (St. Emilion garners eight itself). A cursory glance at his reviews across a selection of left bank 2005, 2009 and 2010s suggests his opinion of ‘a relatively minor margin’ is rather at odds with other people’s opinion. However, therein the crux lies; it is an opinion albeit from the pre-eminent critic of the last thirty odd years.

The debate will continue, but if recent activity is anything to go by the market is convinced of its merits, as are we.

Beyond Bordeaux

Burgundy prices remain buoyant. However, it may be prudent to take advantage of demand for top wines from the likes of DRC, Rousseau, Cathiard and Fourrier to name a few. Barolo, Brunello and super Tuscans continue to draw buyers away from their traditional Bordeaux haunts, though happily the breadth and depth of wines available mean prices remain reasonable. Otherwise the 2008 Champagnes are garnering impressive reviews with critics drawing comparisons with the magnificent 1996 vintage. The majority of houses are yet to release their 2008s but it is a vintage we will follow closely.

There have been encouraging signs in the first six months of the year. One hopes momentum is not lost over the coming six months.

Written By

Written By